Corporate Principles

Our mission statement is “a business is only as good as the people in it, and is the sum of their combined efforts” and “better quality products at more reasonable prices.” Rooted in a philosophy of “shareholder emphasis,” “customer emphasis,” and “endeavors to improve the lives of employees,” the Company is dedicated to growing and developing as an “advanced company specializing in papermaking tools” that offers highly functional products that accurately respond to market needs.

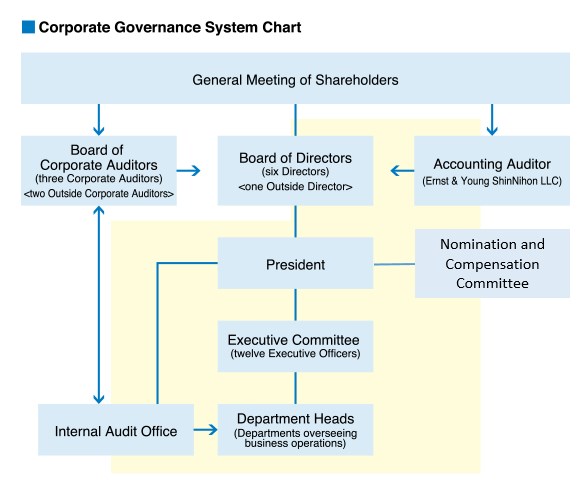

The Company is committed to ensuring management efficiency, integrity and transparency to serve the interests of our various stakeholders. Since realizing effective corporate governance throughout management is a critical topic in enhancing corporate value, we have formulated the following corporate governance framework.

- Based on a comprehensive governance structure that encompasses our business operations, business characteristics and other areas, and utilizing an appropriate Board of Corporate Auditors System, we shall establish a corporate governance framework capable of responding to risks brought about by changes in the legal system, economic globalization and other factors.

- In striving to revitalize the Company’s Board of Directors through more complete management strategies and accelerating the decision-making process, we reduced the number of Directors in June 2003, and shortened appointments for Directors to one year to further clarify Director responsibilities and performance. Furthermore, we introduced an Executive Officer System to ensure the execution of business operations. Note that we elected Outside Directors in June 2015 to ensure management transparency and strengthen our oversight functions.

- We have established the Nominating and Compensation Committee consisting of Outside Directors, Outside Corporate Auditors, and the Representative Director with the aim of further increasing transparency and objectivity of decision-making processes with respect to nomination of candidates for Directors and Corporate Auditors, as well as executive compensation structures and standards.

- With regard to the Corporate Auditors System, in accordance with the auditing policies of the Board of Corporate Auditors, we shall undergo statutory audits and publish audit reports of quarterly financial results and other materials following independent internal audits, strengthening our Corporate Auditor functions.

We shall enact an effective governance framework in response to future changes in the business environment, targeting sustainable corporate growth and increased corporate value over the mid-to long-term—the objective of the Corporate Governance Code.

- Framework to ensure that Directors of the Company and its subsidiaries comply with relevant laws and the Articles of Incorporation in the execution of their duties, and to ensure the appropriateness of business operations.

- Framework to ensure that Directors of the Company and its subsidiaries comply with relevant laws and the Articles of Incorporation in the execution of their duties:

- Board of Directors shall determine the execution of the Company’s business operations in accordance with relevant laws, the Articles of Incorporation, and Board of Directors bylaws.

- Formulate internal regulations, including a “Corporate Code of Conduct” and “Compliance Regulations,” and while rigorously supervising compliance with these internal regulations, prevent violations of relevant laws and other regulations.

- Seek advice from the Company’s attorney and other specialists as required regarding the legality of duties executed by Directors of the Company and its subsidiaries.

- Framework governing information storage related to the execution of duties by Directors:

- Appropriately store and manage the minutes of Board of Directors meetings, Executive Committee meetings, requests for approval, account ledgers and other materials, as well as information at each department based on related regulations.

- Directors and Corporate Auditors shall always have the opportunity to review these documents.

- Regulations for managing risks of losses at the Company and its subsidiaries, and other frameworks:

- As regulations concerning the management of risks of losses, we formulated “Risk Management Regulations," and thoroughly examine, evaluate and devise countermeasures for risks that the Company and its subsidiaries shall manage.

- Pursuant to Risk Management Regulations, department heads shall implement appropriate precautions and countermeasures to address each risk.

- The Executive Committee shall periodically evaluate the effectiveness of risk management procedures, and take necessary corrective action.

- Should risks emerge that have a significant impact on the management of the Company and its subsidiaries, establish a task force headed by the President, and work to minimize losses.

- Framework to ensure that Directors of the Company and its subsidiaries efficiently execute their duties:

- Directors, Executive Officers and each department head rigorously execute their duties in compliance with relevant laws, the Articles of Incorporation, management regulations and executive standards.

- Adopt an Executive Officer System to clarify executive responsibilities and facilitate the efficient execution of business operations.

- Based on management regulations, the Board of Directors shall devise a mid-term business plan and an annual plan, and oversee the execution of these plans.

- President, Executive Officers and each department head execute and manage business operations with an emphasis on achieving targets outlined in business plans.

- President and Executive Officers report on the status of business operations at periodic Board of Directors meetings held monthly.

- Strengthen business management framework at subsidiaries by dispatching executives to subsidiaries from the Company; administrative departments provide guidance and oversight to subsidiaries pursuant to management guidelines for affiliated companies, ensuring subsidiaries appropriately and effectively execute their duties.

- Framework to ensure employees of the Company and its subsidiaries comply with relevant laws and the Articles of Incorporation when executing their duties:

- Develop internal regulations, including a “Corporate Code of Conduct” and “Compliance Regulations”; each department head shall rigorously enforce these internal regulations to prevent legal and other violations.

- Establish an “Internal Audit Office” that is under the direct control of the President, and strengthen internal management functions relating to the legality of regular business operations and the effective execution of the budget.

- Framework to ensure appropriate business operations by the group composed of the Company and its subsidiaries:

- Strengthen our subsidiaries’ business management framework by dispatching executives to subsidiaries from the Company.

- Departments at the Company responsible for managing affiliated companies shall be obligated to periodically file reports concerning important issues in subsidiaries, pursuant to management guidelines for affiliated companies.

- Incorporate the Company’s subsidiaries’ budgets in the budget management system, and obligate each subsidiary to file reports to the Executive Committee concerning the status of the budget every month pursuant to regulations concerning the budget management system.

- Procedures concerning employees selected by Corporate Auditors to support their duties, and procedures concerning independence from Directors of those employees:

- To provide the best auditing environment for conducting audits by Corporate Auditors, when Corporate Auditors request the selection of employees to support their duties, those employees shall be promptly appointed.

- When employees have been selected to support Corporate Auditors, appointment and dismissal of those employees shall be subject to approval from the Board of Corporate Auditors.

- Procedures relating to the effective execution of instructions to employees selected to support the duties of Corporate Auditors:

The right to provide orders and instructors to employees that have been selected to work under the Board of Corporate Auditors as workers selected to support the duties of Corporate Auditors shall belong to Corporate Auditors. Moreover, matters regarding treatment (including appraisals), disciplinary action and other measures, shall only be implemented upon prior consultations between the Company and Corporate Auditors.

- Framework for reporting to the Corporate Auditor:

- The Company shall establish frameworks that enable Corporate Auditors to obtain necessary information from Directors and employees whenever necessary through means that involve conducting business audits,internal audits and other procedures.

- Directors shall promptly report legal matters and matters that have a material impact on the management of the Company to the Corporate Auditor.

- Based on the bylaws of the Board of Corporate Auditors, when necessary, the Corporate Auditor shall require reports from Accounting Auditors, Directors, Executive Officers, employees and other personnel of the Company and its subsidiaries.

- Based on procedures governing whistleblowing, information regarding whistleblowing shall be reported to the Corporate Auditor by the Internal Audit Office.

- Framework to ensure that individuals that report information to Corporate Auditors are not subject to unfair treatment because of the report:

The Company shall maintain procedures that protect individuals that report information to Corporate Auditors from receiving unfair treatment from the Company or its subsidiaries because of the report. - Procedures concerning the prepayment or reimbursement of expenses that emerge relating to the execution of Corporate Auditor duties, and other policies for disposal of expenses and debts that emerge during the execution of duties by the Corporate Auditor:

Should the Corporate Auditor file a claim to the Company for the prepayment or reimbursement of expenses incurred in connection with the execution of their duties, pursuant to Article 388 of the Company Act, the Company shall promptly dispose of the expenses or debts. - Other frameworks to ensure Corporate Auditors perform effective audits:

- The Company shall provide the best environment for Corporate Auditors to conduct audits.

- Discussions with the President and the Board of Corporate Auditors shall occur at regular intervals.

- Full-time Corporate Auditors shall be provided with the opportunity to attend major meetings.

- A system shall be established that allows the Board of Corporate Auditors to collaborate with the Internal Audit Office.

- Framework to ensure reliability of financial reporting:

Ensure reliability of financial reporting by establishing internal controls governing financial reporting, and providing appropriate management of evaluations and reporting, based on the Financial Instruments and Exchange Act and other relevant laws and regulations.

- Framework to ensure that Directors of the Company and its subsidiaries comply with relevant laws and the Articles of Incorporation in the execution of their duties:

Disclosure Policy

<Basic Policy>

The Company is committed to ensuring management transparency and satisfying its responsibility to society through communications with shareholders and broader society. Furthermore, in order to facilitate an understanding of the Company, we shall fairly, timely and appropriately disclose corporate information.

- The Company shall disclose corporate information in accordance with relevant laws and shall voluntarily and impartially disclose other corporate information determined to be important.

- Establish an effective internal structure to facilitate accurate and impartial information disclosure.

- Disclosure via methods appropriate for each information such as through securities reports, timely disclosure to the securities exchange, notifications and the Company’s website.

2. Method for Information Disclosure

For information meeting requirements to be classified as important information pursuant to Securities Listing Regulations stipulated by the Tokyo Stock Exchange, upon providing a prior explanation to the Exchange, register and publish the information via the Tokyo Stock Exchange’s Timely Disclosure Network System (TDnet). Following registration, the identical information shall be provided to media organizations and promptly uploaded to the Company’s website.

3. Future Outlook

Information disclosed concerning forecasts and the future outlook are based on information available at the time of disclosure. The Company does not promise or guarantee the achievement of future targets or measures. Actual results and performance may differ from forecasts and the future outlook due to various risk factors and uncertainties going forward.